News Content:

In the world of food packaging, there's a magical material—high-barrier film—that safeguards food quality and safety. As consumers' expectations for shelf life and freshness continue to rise, the high-barrier film market is experiencing unprecedented growth opportunities. This global observation report will delve deeper into this sector, exploring China's unique position and development prospects within the global market landscape.

Global Market: Differentiated Landscapes Between Emerging and Developed Economies

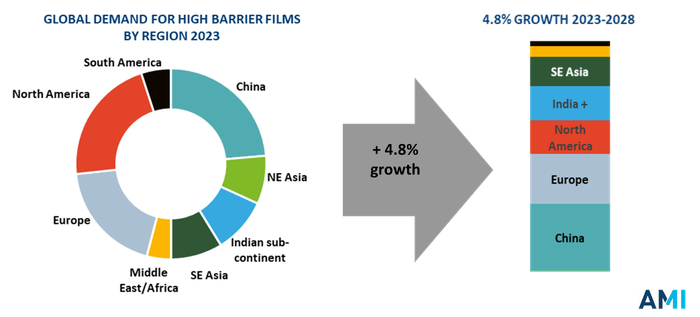

According to data from AMI, a leading UK plastics industry research organization, the global market for flexible film for food packaging is projected to exceed 25 million tons in 2024. Emerging markets such as Southeast Asia, India, and China demonstrate strong consumption potential, accounting for half of the global consumption of basic films. Developed economies such as North America, Europe, and Northeast Asia hold a 37% market share, but their robust demand for high-end specialty films contributes significantly to market value.

Regional Compound Growth Rate of High-Barrier Films from 2023 to 2028

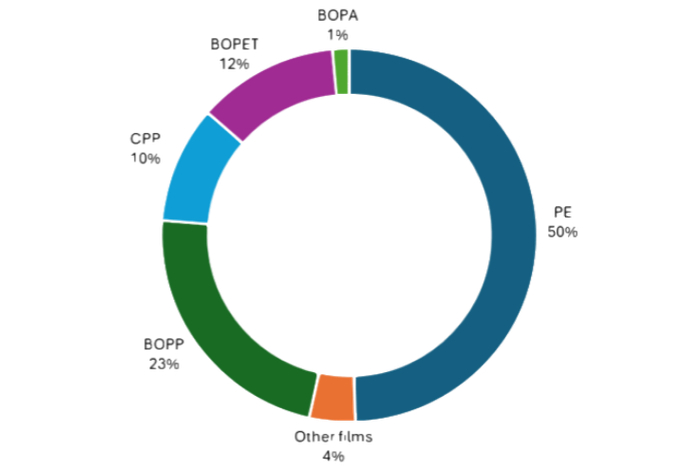

By substrate, PE film holds the largest market share in the food packaging market, driven by its sustainable development advantages and continuous resin technology upgrades. This leading position is expected to continue until 2028. Biaxially oriented polypropylene (BOPP) follows closely behind, with strong future growth momentum.

Regional Compound Growth Rate of High-Barrier Films from 2023 to 2028

By substrate, PE film holds the largest market share in the food packaging market, driven by its sustainable development advantages and continuous resin technology upgrades. This leading position is expected to continue until 2028. Biaxially oriented polypropylene (BOPP) follows closely behind, with strong future growth momentum.

Global Food Packaging Film Substrate Demand Distribution in 2023

In 2024, high-barrier films will account for nearly 10% of the total food packaging film volume. PE-based films, with nearly half of the market share, are the most in-demand type of high-barrier film globally. Biaxially oriented polyester (BOPET), with its excellent price-performance ratio, holds approximately one-third of the market share, and its demand is expected to continue growing until 2028. Although BOPET faces some replacement pressure in the European and American markets, its exit from the market is slow due to high equipment modification costs and weak performance of alternative materials. Nylon (PA) film, despite a potential decline in its share in the European market due to recyclability disputes, maintains its expected growth trend in the global market. Although BOPP film currently holds only 8% of the market share, its growth rate is expected to outpace other films through 2028, benefiting from the development trend of single-material packaging.

In terms of application, fresh cold-chain foods (such as meat, seafood, and dairy products) remain the primary application for high-barrier films. Notably, snack packaging will be the fastest-growing application area, with increasing retailer demand for high-value-added meat protection further driving market growth in this sector.

In China, demand for high-barrier films in the food packaging industry is also booming. With the rise of e-commerce and increasing consumer awareness of food safety and quality, the market for high-barrier films holds promising prospects.

According to incomplete statistics, my country's demand for composite flexible packaging is approximately 2 million tons, with barrier packaging films experiencing rapid growth in their use. Domestically produced barrier films are primarily used in food packaging. In 2021, my country's plastic flexible packaging for food and beverages reached 7.247 million tons, accounting for approximately 70% of total flexible packaging. By 2022, this figure is expected to rise to 10.48 million tons. It is estimated that by 2025, the demand for high-barrier packaging materials for low-temperature meat, poultry, and aquatic products will reach 131,000 tons, the demand for room-temperature flexible packaging high-barrier materials for snack food packaging will reach 1.988 million tons, and the demand for high-barrier materials for retort-based food packaging will reach 1.215 million tons. These figures will undoubtedly drive the rapid development of my country's high-barrier film packaging materials industry.

Barrier Technology Competition

Barrier technologies for food packaging films primarily include five categories: aluminized film, ethylene-vinyl alcohol copolymer (EVOH) film/coating, polyvinylidene chloride (PVDC) film/coating, aluminum/silicon oxide (AlOx/SiOx) coating, and others (primarily polyvinyl alcohol (PVOH).

EVOH film and coating maintain their dominant position due to their excellent oxygen barrier properties (requiring a moisture barrier layer). They are often co-extruded with PE to form a five-layer PE/EVOH/PE structure. Due to the high consumption of meat and dairy products, Europe has become the largest market for EVOH and is rapidly replacing PVDC. Aluminum-coated film, driven by its increasingly popular technology, relatively low cost advantages, and attractive decorative appearance, will maintain its second-largest share of the high-barrier film market in 2024. Globally, aluminum-coated film is primarily based on BOPET, with China being the largest producer. The Indian subcontinent is also expected to further increase its global market share.

Polyvinyl alcohol (PVOH) is rapidly gaining traction in the Chinese market, gradually replacing PVDC and expensive imported EVOH resins. PVOH is expected to experience rapid growth in all regions globally, with the exception of Northeast Asia. Initially developed in Northeast Asia as a replacement for polyvinylidene chloride (PVDC), its continued growth is primarily driven by its successful market penetration in autoclave packaging applications, such as microwaveable bags.

AlOx/SiOx coatings, while small in size, are particularly strong in applications such as microwaveable bags, benefiting from sustainable regulations. They are expected to achieve the highest growth rates through 2028.

Polyvinylidene chloride (PVDC) films and coatings are the only technical solution that excels in volume stability. This long-standing transparent barrier material, due to its comprehensive barrier properties, processability, and cost advantages, is widely used in coating, coextrusion, and composite film production. However, environmental concerns surrounding PVDC's chlorine content, which may produce harmful emissions, have prompted the industry to turn to alternatives. Global brand owners are gradually phasing out the material, and several bans have been enacted in Europe to restrict its use.

Processing Technology: Innovation Drives, Pushing Performance Boundaries

In terms of processing technology, innovative processes such as MDO-PE (mechanically oriented polyethylene) and BOPE (biaxially oriented polyethylene), as well as advances in coating technology, are driving the continued expansion of high-barrier film applications in areas such as stand-up pouches and retort pouches. This type of packaging is not only convenient but also meets current sustainability standards, making it highly sought after in the market.

With the continuous advancement of technology, emerging technologies are beginning to emerge in the field of high-barrier film processing. The application of nanotechnology, by adding nanoscale barrier materials to films, can significantly enhance barrier properties while also achieving lightweighting. The development of smart packaging technologies, such as integrated sensors, QR codes, and radio frequency identification, has enabled high-barrier films to not only provide traditional barrier functions but also enable real-time monitoring of food status, providing consumers with more information.

Against the backdrop of growing global environmental awareness, sustainable development has become an inevitable trend in the development of the high-barrier film industry. Governments around the world have introduced stringent environmental regulations, placing higher demands on the recyclability and biodegradability of packaging materials. For example, Europe's Packaging and Packaging Waste Regulation (PPWR), which will take effect on January 1, 2030, explicitly requires all packaging structures to be recyclable before being marketed, accelerating the industry's move towards recyclable high-barrier films. Some companies have developed all-PE high-barrier films, utilizing specialized processes and formulations to achieve high-performance barrier properties from a single material. This significantly simplifies the recycling process and facilitates direct recycling. Although some brands have proposed shifting from BOPET and BOPA to paper-based or polyolefin-based materials, such a transition often requires compromises and sacrifices in performance parameters. The greater technical challenge lies in reducing film complexity to enhance recyclability while also achieving an oxygen transmission rate (OTR) below 10. Current breakthroughs in barrier coating technology are providing solutions for this development, encompassing both plastic and paper-based materials. Consumers' strong preference for paper-based packaging has prompted brands to actively explore high-barrier paper-based materials. While their barrier performance currently cannot match that of traditional plastic-based barrier films, breakthroughs in this area will profoundly impact the future market landscape for high-barrier films.

In China, with the introduction of the "dual carbon" goals, the food packaging industry is also actively exploring sustainable development. On one hand, efforts are underway to increase the research and development and application of biodegradable high-barrier film materials, such as high-barrier films made from bio-based materials such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA). These films exhibit excellent biodegradability and can be broken down by microorganisms under certain conditions, effectively reducing the environmental impact of plastic waste. On the other hand, efforts are underway to promote lightweight packaging design, improving the barrier properties of films while reducing the amount of packaging material used while ensuring food packaging quality. Future Outlook: Opportunities and Challenges

The market for high-barrier films for food packaging is in a critical period of rapid development. Looking ahead, the market is fraught with both opportunities and challenges. At Bisheng Packaging, we will continue to evolve as consumers' demands for food quality and safety continue to rise. In terms of technological innovation, we will continuously develop more efficient and environmentally friendly processing technologies and new materials to meet the increasingly diverse market demands. However, we also face numerous challenges. Fluctuations in raw material prices, increasingly stringent environmental regulations, and intensifying market competition will all pose challenges to our business development. We will fully embrace these developments and challenges, bringing you a diverse and high-quality product experience. We warmly look forward to your communication and cooperation.